Federal Energy Tax Credit

Federal Energy Tax Credit - Form 1040

Building a green home or renovating an older home to be more energy efficient can often be a costly endeavor. Efficient products are typically more expensive than their more traditional counterparts. Even though the energy savings of these items will usually make up for the difference in price (or even pay for the entire item) over their lifetime, the higher up-front costs often put them out of reach for people on a tight budget.

To help encourage the use of energy efficient products in an effort to lower our nation's use of polluting, non-renewable sources of energy, federal and state governments often offer tax credits to homeowners. These tax credits are designed to lessen the short-term financial blow of green home construction or renovation.

Federal Tax Credits for Energy Efficiency: Basic Requirements

As anyone who's struggled through filling out a federal tax form every April, the world of tax credits can be confusing and complicated. Tax credits for energy efficiency is no different. Tax credits can change from year to year, and they all expire at some point. Tax credits offered on energy efficient products in 2009 and 2010 are no longer available. Some energy efficiency tax credits run through 2011, some don't end until 2016. We'll try to straighten out this information for you as much as possible in this series of articles.

Here are some items that have tax credits available through December 2011 (products must be purchased and installed in your primary residence):

- Biomass Stoves

- HVAC Systems

- Insulation

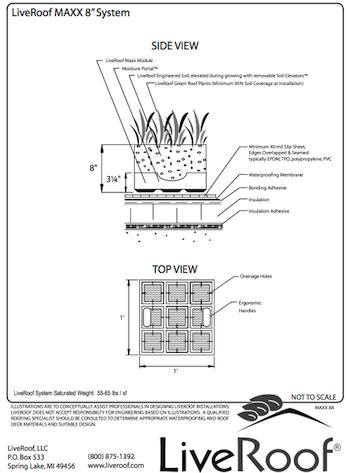

- Roofing

- Water Heaters (non-solar)

- Windows, Doors, and Skylights

There is a $500 lifetime limit on the federal tax credits that expire in December 2011. If you have received a total of $500 or more in these tax credits from 2006-2010, you are not eligible for any more. We will explore these 2011 items in more detail in separate articles.

These products are eligible for federal tax credits through 2016. Tax credits on these items are at the rate of 30% of the cost with no upper limit:

- Geothermal Heat Pump

- Solar Energy Systems

- Wind Energy Systems

- Fuel Cells

Again, we will investigate the energy tax credits of the items with tax credits expiring in 2016 in further detail in forthcoming articles.

How to Claim Your Federal Energy Tax Credit

To claim an energy tax credit, you will need the proper form from Uncle Sam. All federal tax forms are available at the IRS website

Make sure you have the correct forms for the tax year you are filing. For renewable and efficiency credits, use form IRS Form 5695.

Save all receipts and the manufacturer's certification statement from each item for your records.

These tax credits are non-refundable: they are only available to the extent you have a tax liability.

Tax credits can only be claimed once, and are limited to the year in which the item is purchased. if you claimed a home energy improvement tax credit on 2010 taxes, you can't take an additional credit for the same purchase on your 2011 taxes. Seems like common sense, but it's worth mentioning.

As mentioned earlier, there is a $500 lifetime limit on the federal tax credits that expire in December 2011. If you have already received a total of $500 or more in energy tax credits from 2006 to 2010, you aren't going to get any more. (This does not apply to the tax credits that expire in 2016.)

Additional Energy Tax Credits You May Be Eligible For The energy tax credit fun doesn't stop at the federal level. Oh no. Federal tax credits can be combined with other state, local, and utility credits, rebates, or incentives. To see what other incentives are offered in your neck of the woods, visit the Database of State Incentives for Renewable's and Efficiency.

Appliances with the Energy Star certification can also qualify for state rebates. You can learn about rebates available in your state HERE:

You already know that building green and using energy efficient products is the right thing to do for the planet. Taking advantage of the rebates offered by the federal government and other various state and local credits can make your environmentally-sustainable home a bit more financially sustainable, as well.

comments powered by Disqus