Energy Tax Credit - Roofs, Water Heaters, Doors & Skylights

Energy Tax Credit - Roofing Materials

Making improvements to your home to reduce its energy usage is a smart idea, both to save money and to reduce the environmental impacts of your home.

The Federal Government has some tax credits in place for the calendar year 2011 to help offset the cost of making efficiency improvements to your existing home. Tax credits for biomass stoves, HVAC systems, insulation, and windows have been discussed in previous articles.

Here we will look at the remainder of the available energy tax credits for 2011. All of the 2011 tax credits are for existing, primary residences only.

2011 Energy Tax Credit: Roofing

Installing new metal or asphalt shingle roofs by December 31, 2011 will qualify for a tax credit. The credit amount is 10% of the material cost up to $500. It covers materials only; installation and labor costs are not eligible.

The roofing tax credit is for any metal or asphalt roof installed "on a dwelling unit, but only if such roof has appropriate pigmented coatings or cooling granules which are specifically and primarily designed to reduce the heat gain of such dwelling unit."

All Energy Star qualified metal and reflective asphalt shingles will qualify for the 2011 energy tax credit.

See our articles on green roofing materials for more information on energy efficient roofing options.

GAF Asphalt Shingles

Metal Roofing Materials

Photovoltaic Shingles

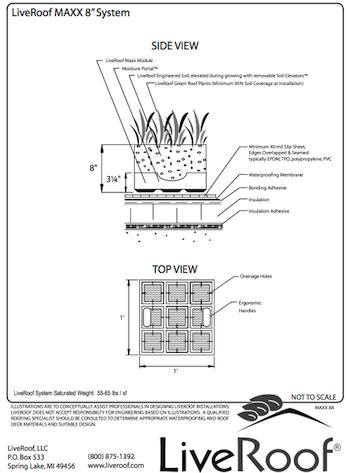

Green Roof Systems

Tamko Shingles

2011 Energy Tax Credit: Water Heaters (non-solar)

Energy Tax Credit - Rinnai Instant Water Heaters

A new, efficient hot water heater can greatly reduce your home's energy usage. A new gas, oil, or propane hot water heater will qualify for the 2011 tax credit if they have an Energy Factor > = 0.82 or a thermal efficiency of at least 90%.

The 2011 tax credit for efficient hot water heaters (non-solar) DOES include installation costs.

All Energy Star gas tankless (also known as on-demand or instantaneous) hot water heaters qualify for the tax credit. Learn more about tankless water heaters here.

Rinnai Tankless Water Heater

Bosch Tankless Water Heater

*Important* Most storage tank water heaters will not qualify for the credit due to their lower efficiency. Also, electric storage tank and electric tankless water heaters are not eligible for the tax credits. The water heater MUST be gas, oil, or propane powered.

The tax credit is available for electric heat pump water heaters with an Energy Factor > = 2.0. All Energy Star heat pump water heaters will qualify.

2011 Energy Tax Credit: Doors and Skylights

Installing new exterior doors and skylights can qualify for the 2011 tax credit if they are Energy Star labeled products. The credit is 10% of the cost, up to $500. As mentioned in the window tax credit article, windows are capped at $200.

Our articles on efficient windows, doors and skylights can help you select the greenest products available.

Andersen Windows

Pella Windows

Skylight Windows

Solar Tubes

How to Claim Your 2011 Energy Tax Credit

To claim these 2011 energy tax credits, you will need to fill out IRS Form 5695 http://www.irs.gov/pub/irs-pdf/f5695.pdf and include it with your tax returns. On the 1040 tax form, the residential tax credit (from Form 5695) is claimed on line 52.

Save the receipts (or copies of them) as well as the Manufacturer Certification Statement from the product for your records. A reputable contractor will be able to assist you with obtaining the required certification statement and helping you navigate the tax credit paperwork. And, of course, your income tax preparer should also be able to assist you with any tax questions you may have regarding the energy tax credits for 2011.

Important Considerations

Here are a few important things to remember about the 2011 Energy Tax Credits:

- The credits are non refundable; they are only available to the extent you have a tax liability.

- Tax credits may only be claimed once, and are limited to the year in which the qualifying product is purchased. If you have already claimed a home energy improvement tax credit on your 2010 taxes, you may not take an additional credit for the SAME purchase on your 2011 taxes.

- There is a $500 lifetime limit on the federal tax credits that expire in December 2011. If you have received a total of $500 or more in these tax credits from 2006 to 2010, you will not be eligible for any more.