Energy Tax Credits

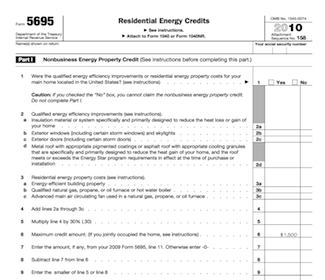

Federal Energy Tax Credit:

Building green can be expensive in the short-term and somewhat daunting. Thankfully there is some relieve, at least on the tax front for those of us wishing to live a bit more sustainable.

Taking advantage of available federal tax credits for energy efficient products can reduce up-front costs, making it easier than ever to build a green, sustainable home.

To find out how to qualify for your tax credit, please visit our article Federal Energy Tax Credit.

Window Tax Credit:

Replacing windows with new, efficient Energy Star qualified windows can reduce your energy bills by a substantial amount. A 2011 Federal Tax Credit for Energy Star windows can reduce their cost, as well and make replacing your windows a great way to get some tax money back and enjoy a greener lifestyle.

To find out how to qualify for your tax credit, please visit our article Window Tax Credit.

Energy Tax Credit Insulation:

Adding insulation to an existing home can greatly reduce your energy usage, and cost. Doing so in 2011 can qualify you for up to a $500 energy efficiency tax credit from the Federal Government. Some of these insulation installations can even be placed by a do-it-yourself owner (which is great since the credit does not include installation.)

To find out how to qualify for your insulation tax credit, please visit our article Energy Tax Credit Insulation.

HVAC Tax Credit:

Purchasing and installing a new HVAC system for your existing home can greatly reduce your home's energy usage and cost.

Some new HVAC systems qualify for 2011 energy tax credits if installed by December 31, 2011.

To find out how to qualify for your HVAC tax credit, please visit our article HVAC Tax Credit.

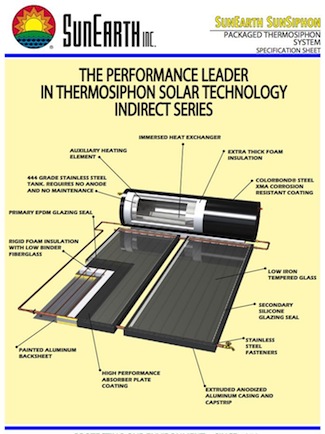

Solar Hot Water Credit:

Installing solar hot water or photovoltaic systems to your new or existing home can greatly reduce the home's environmental impacts, but can be a costly investment. The Federal Government offers a tax credit for these solar energy systems of 30% of the systems total cost, with no limit. Qualifying solar energy systems need to be placed in service by Dec. 31, 2016.

To find out how to qualify for your Solar Tax credit, please visit our article Solar Hot Water Credit.

Energy Tax Credits 2011 for Wind Energy:

Harnessing the power of the wind to create energy for the home is becoming more popular. The Federal Government is offering an energy tax credit for wind energy systems to homeowners of 30% of the cost of the system, with no upper limit. The wind energy system must be placed in service by Dec. 31, 2016.

To find out more about getting your tax credit for a wind generator, be sure to visit our article Energy Tax Credits 2011 - Wind Energy.

Energy Tax Credit for Roofing, Water Heaters, Doors and Skylights:

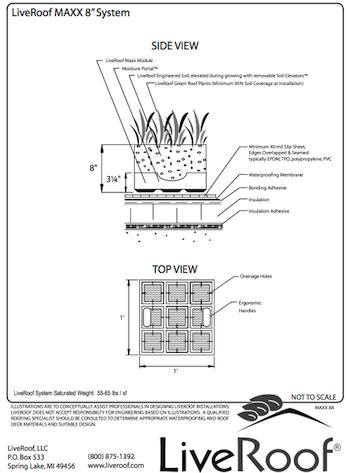

Improving your home's energy efficiency is a wise thing to do; the Federal Government is offering some energy tax credits in 2011 to help make these improvements more affordable. installing qualified roofs, water heaters, doors or skylights in 2011 can qualify for up to $500 in tax credits.

To find out more about getting your tax credit for these popular construction elements, be sure to visit our article Energy Tax Credit - Roofing, Water Heaters, Doors and Skylights.

comments powered by Disqus